The Impact of 2025–2026 Vape on Online Shopping Trends

Regulatory Hurdles Meet Technological Demand

The landscape for online retailers dealing in vape, nicotine, and CBD products is undergoing a profound transformation in 2025 and 2026. This shift is characterized by two major forces: a surge in market valuation driven by consumer demand for healthier, smarter products, and a dramatic increase in state-level regulatory complexity that directly dictates the feasibility and cost of e-commerce fulfillment.

This statistical report analyzes how these simultaneous pressures, rapid growth fueled by innovation and severe operational constraints imposed by compliance mandates, are reshaping online shopping trends in the vapor and alternative nicotine sector.

Statistical Highlights: Market and Compliance Snapshot

| Metric | Data Point | Context / Reference |

|---|---|---|

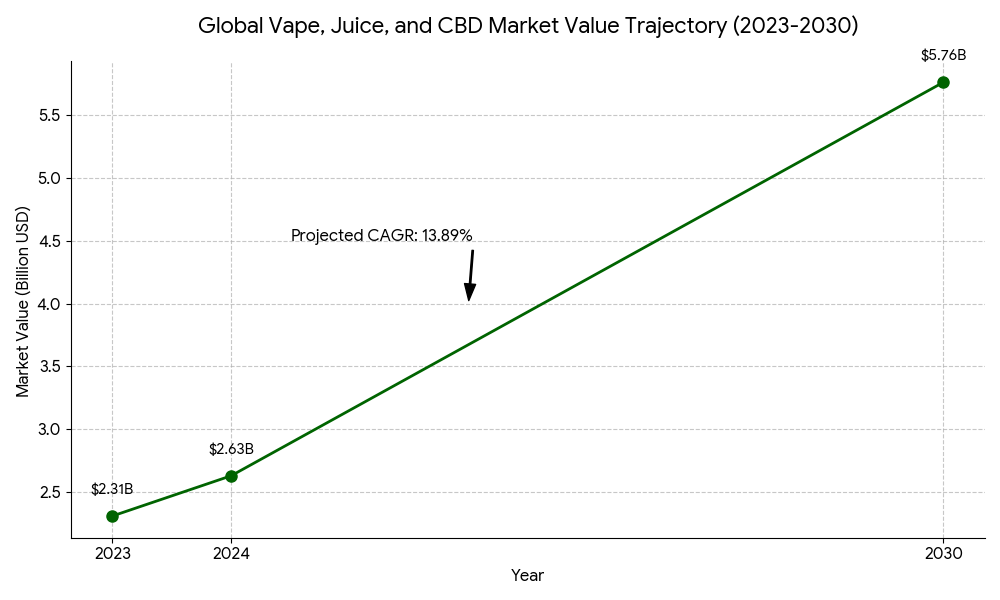

| Market Valuation Growth | Projected to reach USD 5.76 billion by 2030. | Represents a CAGR of 13.89% from 2024 to 2030. |

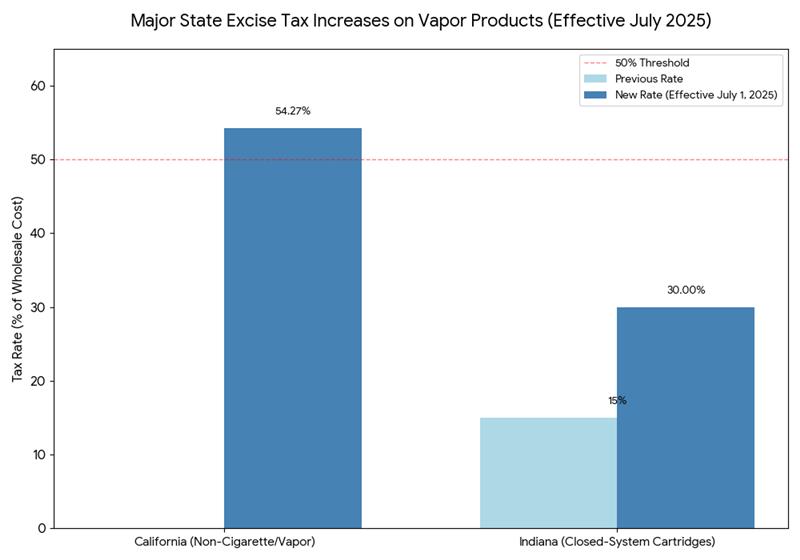

| Excise Tax Hike (CA) | Excise tax increases to 54.27% of the wholesale cost. | Effective July 1, 2025, one of the highest in the country. |

| Excise Tax Hike (IN) | Tax rate on Closed-System Cartridges (CSCs) doubles from 15% to 30%. | Effective July 1, 2025, impacting both CSCs and other nicotine products. |

| New Compliance Mandates | Multiple state changes (CA, IN, NC, WI, MS) take effect in the second half of 2025. | Highlights immediate operational stress on online retailers. |

| Product Registration Cost (NC) | $2,000 per SKU initially and $500 annually. | A direct financial hurdle for online brands listing unauthorized products. |

| Compliance Penalty (WI) | Potential $1,000 per day, per device penalty. | Reflects the severe financial risk of selling non-certified products. |

Section 1: Market Valuation and Growth Trajectory

The underlying strength of the vape and CBD market provides the necessary motivation for businesses to navigate the emerging regulatory landscape. The convergence of therapeutic benefits and the convenience of inhalation has pushed this industry far beyond its niche origins.

Exponential Growth in CBD/Vape E-commerce

The market has demonstrated a clear trajectory of accelerated growth. The vape, juice, and CBD market grew from USD 2.31 billion in 2023 to USD 2.63 billion in 2024. This strong foundation is projected to result in the market reaching USD 5.76 billion by 2030, reflecting a substantial Compound Annual Growth Rate (CAGR) of 13.89%.

This growth is fundamentally rooted in several long-term consumer trends that impact online shopping:

Therapeutic Demand: Consumers increasingly use CBD e-liquids as non-traditional remedies for issues such as pain and anxiety, favoring vape products for their rapid-onset effects.

Smoking Cessation: CBD and non-nicotine vaping options have gained popularity as wellness alternatives to traditional smoking, broadening the consumer demographic.

Technological Appeal: The shift toward “smart vapes” with features like Bluetooth connectivity, large displays, and puff animations is attracting a tech-savvy consumer base accustomed to seamless e-commerce experiences.

The combination of strong financial incentive (13.89% CAGR) and accelerating technological demand ensures that brands will continue to heavily invest in online distribution, despite the rising compliance costs.

Section 2: The E-commerce Compliance Cliff of 2025

The single most disruptive factor affecting online shopping trends in the 2025–2026 period is the rapid, decentralized proliferation of state-level regulations. These mandates, often effective mid-year, create an “e-commerce compliance cliff,” fundamentally altering how online retailers manage their inventory and logistics.

Major compliance changes across multiple states are scheduled for the second half of 2025, forcing online retailers to adopt highly sophisticated, automated compliance solutions.

Product Bans and Directory Mandates

The need for online product tracking and catalog management has become critical due to new state directories and bans on unauthorized items.

North Carolina’s Ban: Effective July 1, 2025, North Carolina will ban unauthorized disposable vapes, specifically prohibiting flavored brands that have not received FDA authorization or PMTA (Premarket Tobacco Application) submission. For national online stores, this requires immediate, zip-code-level enforcement of product eligibility, meaning an item displayed in New York must be suppressed for a North Carolina shopper.

Registration Hurdles: States like North Carolina and Tennessee are establishing new product directories. North Carolina mandates a manufacturer certification fee of $2,000 per SKU initially, and $500 annually. This directly impacts the online catalog: brands will only be able to list the highest-performing products, leading to market consolidation and reduced SKU diversity on national e-commerce sites. Tennessee will further restrict retailers to purchasing only from licensed wholesalers carrying approved products (effective August 1, 2025), mandating traceability across the entire digital supply chain.

Wisconsin Penalties: The risk of manual error is underscored by Wisconsin’s device certification rule (effective July 1, 2025). Selling a non-certified e-cigarette device in the state can incur daily penalties of $1,000 per day, per device. For an online retailer shipping dozens of SKUs daily, a single compliance lapse can generate fines that instantly cripple the business.

PACT Act Reporting and Data Complexity

The burden of compliance is shifting from simple age verification to complex, state-specific data reporting, directly impacting fulfillment and shipping.

Revised Reporting: Nevada, effective July 2025, will require all nicotine and vapor shipments to adhere to a new monthly PACT reporting format. Similarly, Indiana will require a revised PACT Act reporting structure for its monthly submissions.

Operational Cost: These state-specific reporting formats mean online fulfillment systems must dynamically generate customized shipment data (tracking numbers, SKUs, recipient data) according to the unique requirements of the destination state. Manual management of these varying PACT formats is unsustainable, driving a major trend toward automated, centralized compliance software integration for all online sellers.

Section 3: Financial Impact: Excise Taxes and Operational Costs

The cost of selling vape products online is escalating rapidly due to new tax mandates, which retailers must automate to remain viable. These tax increases directly reduce profit margins and necessitate dynamic pricing engines for e-commerce.

Dramatic Tax Increases

Several states have scheduled significant tax hikes, demanding immediate system updates for online checkout processes.

California Excise Tax: Effective July 1, 2025, California will raise its excise tax on non-cigarette tobacco and vapor products to a massive 54.27% of the wholesale cost. This is one of the highest tax rates in the nation for this category. E-commerce sites operating in California must integrate dynamic tax engines that can handle mid-year recalibrations instantly to avoid non-compliance or loss of margin.

Indiana Cartridge Tax: Indiana will double its tax rate on closed-system cartridges (CSCs) from 15% to 30% of the wholesale price starting July 1, 2025. This dual rate structure (different rates for different product formats) requires SKU-level intelligence at the checkout stage.

The consequence of online shopping trends is a shift away from manual sales operations. Compliance has moved from a legal issue to an unavoidable technological hurdle. Businesses that fail to integrate dynamic, state-specific tax and product eligibility verification systems directly into their e-commerce platform face existential financial risk.

Read More: How Many People Vape in the World

Section 4: Consumer Demand and Product Innovation Trends

While regulatory friction makes selling harder, the consumer base continues to evolve, creating demand for specific product attributes online. These trends keep the market dynamic and attract investment despite the compliance challenges.

The Rise of Health-Conscious and Sustainable Shopping

The CBD market’s growth, with its therapeutic appeal, is closely tied to health-consciousness. This segment demands transparency and responsible sourcing:

Focus on Wellness: Consumers are favoring non-nicotine alternatives and products highlighting therapeutic benefits like stress relief, pain management, and improved sleep. Online retailers are responding by prioritizing product transparency and lab results on their e-commerce listings.

Sustainability Vaping: Environmental concerns are directly influencing purchasing decisions online. Trends include the use of biodegradable materials in disposable vape pens and pod kits (e.g., plant-based plastics or bamboo) and the increased adoption of refillable vape devices to reduce waste. Online brands that emphasize recycling programs or eco-friendly packaging gain a competitive edge.

Technology Integration

The trend toward smarter vaping devices is supported by the tech-focused nature of e-commerce. As devices become more sophisticated, integrating features typically seen in smartphones, the online shopping experience must match that sophistication, focusing on rapid fulfillment and enhanced digital customer service.

Conclusion: Compliance is the New E-commerce Battleground

The vape and alternative nicotine sector in 2025 and 2026 is defined by a critical paradox: immense market potential (a projected 13.89% CAGR to USD 5.76 billion by 2030) is being aggressively countered by regulatory mandates that threaten the viability of current online business models.

The primary online shopping trend is not driven by consumer whim, but by operational necessity. Manual compliance is no longer feasible given the severity of the financial penalties (e.g., Wisconsin’s $1,000 per day fines and the complexity of the requirements (e.g., California’s 54.27% excise tax recalibration.

Successful online retailers are shifting capital toward integrating automated, centralized compliance systems capable of performing real-time age verification, dynamically calculating state-specific taxes, suppressing unauthorized SKUs based on location, and generating the complex data required for PACT reporting. For the high-growth vapor e-commerce market, technological compliance is no longer optional; it is the fundamental infrastructure for sustained revenue.