Global Hemp Industry Market Size

The global industrial hemp and hemp oil markets are rapidly becoming multi-billion-dollar industries underpinned by way of sustainability needs, expanding programs throughout sectors, and favorable regulatory shifts. With programs ranging from textiles, production, vitamins, and personal care to rising bio-composites, those markets are projected to reveal a stellar boom through 2035.

This unique marketplace review integrates the latest available statistics, developments, and forecasts to provide a clean photograph of modern-day dynamics and future possibilities.

Content

– Key Global Industrial Hemp Latest 2026 Statistics

– How Big is the Industrial Hemp Market

– Segment Analysis: Industrial Hemp Product & Application Breakdown

– Hemp Seed & Hemp Seed Oil Nutritional and Wellness Growth Engine

– Hemp Hurds/Shivs: Versatile Construction & Bedding Materials

– Specialty Hemp Extracts: Emerging Wellness & Industrial Chemicals

– Regional Market Insights & Growth Patterns

– Emerging Hemp Oil Market: Size & Forecast (2025–2032)

– Industrial Hemp Market Growth Drivers & Statistical Insights

Key Global Industrial Hemp Latest 2026 Statistics

– The global industrial hemp market at about USD 11.42 billion in 2025.

– The market is projected to reach USD 47.82 billion by 2032, growing at a 22.7% CAGR.

– Long-term forecasts estimate the industrial hemp market could exceed USD 100 billion by 2035.

– Hemp fiber accounts for over 50% of global hemp processing and was worth USD 12.01 billion in 2024.

– The hemp fiber segment is projected to reach USD 95.46 billion by 2032.

– The global hemp seed oil market was valued at USD 1.95 billion in 2024.

– Hemp seed oil is projected to reach USD 10.24 billion by 2032, with a 23.37% CAGR.

– Europe held about 31% of the global industrial hemp market and 46.67% of the hemp seed oil market in 2024.

How Big is the Industrial Hemp Market?

Current Size & Long-Term Growth 2035

Industrial hemp, derived from cannabis sativa containing low levels of THC, has become a cornerstone of sustainable industrial fabric techniques globally. Throughout a couple of forecasts, the economic hemp market is projected to make bigger appreciably within the coming decade.

Industrial Hemp Market Size & Forecast

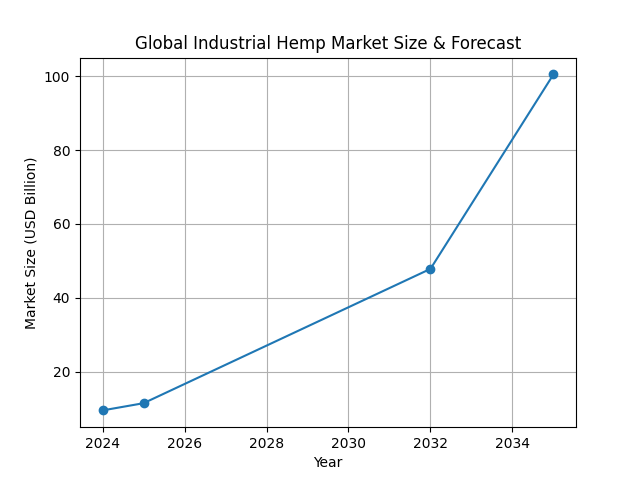

The global industrial hemp market was estimated at USD 9.47 billion in 2024 and is projected to reach USD 11.42 billion in 2025, reflecting strong demand across multiple end-use industries.

Major reports anticipate the market to grow to USD 47.82 billion by 2032 at a robust CAGR of 22.7% from 2025 to 2032, driven by expanding applications in textiles, food, and personal care.

Long-range forecasts extend this growth further: one projection estimates the market could reach USD 100.51 billion by 2035 at a CAGR of approximately 22.5% between 2025 and 2035.

Alternative research suggests the industrial hemp market could expand from USD ~8.16 billion in 2024 to approximately USD 37.53 billion by 2032, with a CAGR of around 21% during 2025–2032.

Across these data points, the mid- and long-term consensus highlights strong, sustained growth driven by industrial innovation and rising global demand for sustainable raw materials.

Sources: (Fortune Business Insights), (Market Research Future), (Data Bridge Market Research)

Segment Analysis: Industrial Hemp Product & Application Breakdown

The global industrial hemp market is broadly segmented by key product categories, each contributing uniquely to overall market size, end-use adoption, and future growth. Across textile, construction, dietary, wellness, and industrial applications, these product types are expanding at different rates, driven by shifting consumer demand, advances in material technology, and increasing regulatory acceptance—alongside rising interest in related consumer products such as cheap disposable carts.

Industrial hemp is segmented by product types and applications, each contributing uniquely to revenue streams.

Hemp Fiber – Dominant Segment with Strong Industrial Demand

Hemp fiber remains the largest and most commercially viable full-size product kind in the industrial hemp market, pushed by growing use in textiles, bio-composites, automobile components, and eco-materials.

In 2024, hemp fiber accounted for a giant proportion of overall hemp product processing volumes, with over 50% of global processing attributed to fiber production due to its full-size business utility.

Industry estimates advocate that the hemp fiber market size will become worth round USD 12.01 billion in 2024 and is projected to grow dramatically to USD 95.46 billion by 2032, reflecting a CAGR of about 32.6% from 2026 to 2032.

Consistent with other local reviews, hemp fiber on its own could attain USD 20.96 billion by 2025, up from USD 15.18 billion in 2024, at a 38.0% annual growth rate, pushed through the garb, automotive, and construction industries.

Textiles remain the largest application within the fiber sub-segment, consuming more than 60,000 tons of hemp fiber in 2024, with Asia-Pacific nations like Vietnam and India supplying over 70% of global exports to the U.S. and EU markets.

Industrial adoption of hemp fiber is also expanding into automotive interiors, which used roughly 7,100 tons in 2024, helping manufacturers reduce vehicle weight by up to 25% while meeting sustainability targets.

Overall, hemp fiber’s biodegradability, tensile strength (>700 MPa), low water consumption (about 80% less than cotton), and broad end-use applicability underpin its dominant role.

Source: (Global News Wire), (Renewable Carboon), (Fortune Business Insights)

Hemp Seed & Hemp Seed Oil Nutritional and Wellness Growth Engine

Hemp seed and hemp seed oil are considered the fastest-growing components in the product mix, driven by their dietary, wellness, and beauty uses globally.

According to market research, the worldwide hemp seed market size turned into approximately USD 457.1 million in 2024 and is expected to grow to USD 486.81 million in 2025, reaching around USD 858.04 million by the year 2034 at a 6.5% CAGR. Nearly 48% of demand is associated with hemp oil extraction, while 37% is going into hemp seed cake and 15% to different uses.

In a broader market context, worldwide studies indicate that the hemp seed market, consisting of seeds, oil, and protein merchandise, could develop from about USD 6.03 billion in 2022 to USD 10.89 billion by 2029, with an 8.8% CAGR.

Hemp seed oil’s nutritional profile is considerable in omega-3 and omega-6 fatty acids, a complete amino acid profile, and bioactive compounds, which has expanded its use in nutritional supplements, functional foods, beverage fortification, and private care formulations.

Regional facts indicate North America accounted for roughly 34% of hemp seed demand in 2024 because of its excessive adoption in practical ingredients, whilst Europe and Asia-Pacific held about 28% and 26% stocks respectively.

Hemp seed and seed oil products are more and more included in plant-based milk, protein powders, vitamins bars, and skin care oils, underscoring a robust consumer shift closer to natural and nutrient-rich options.

Source: (Global Growth Insights), (IMARC), (Transparent Market Research)

Hemp Hurds/Shivs: Versatile Construction & Bedding Materials

The woody internal center of the hemp stalk is extensively utilized in animal bedding, creation substrates, and composite materials.

Even though hurds usually have a lower in-step-with-unit cost in comparison to fiber and seed oil, their precise bodily properties, which include excessive absorbency (up to 4x its dry weight), make them an attractive choice for animal bedding products and hempcrete production materials.

Industrial reports highlight that during 2023 on its own, approximately 43,000 metric tons of hemp hurds were utilized in construction applications across important markets such as France, Germany, and Canada, especially in hempcrete panels and insulation products.

Hurds also guide soil amendment and regenerative agriculture, enhancing soil aeration and moisture retention, contributing to sustainable farming practices, and lowering dependency on chemical conditioners.

Generally, even though hemp hurds generate lower revenue per ton than fiber or seed oil, their fast adoption in eco-construction, green constructing substances, and animal care products contributes meaningfully to product diversification and total market size.

Source: (Market Growth Reports), (Global News Wire), (Hemp Powerful)

Specialty Hemp Extracts: Emerging Wellness & Industrial Chemicals

Specialty hemp extracts encompass concentrated bioactive compounds derived from hemp past primary fiber and seed oil processing, including purified cannabinoids (non-CBD), terpenes, flavonoids, and business chemical precursors.

Specialty extracts are more and more included in cosmetics, private care serums, healing topical formulations, and rising commercial chemical products, although precise sales figures vary by way of vicinity and formulation.

While global CBD markets are largely driven by pure extract sales in terms of size, the growing integration of hemp-derived extracts into high-end skincare products, effective topical treatments, and innovative commercial bio-merchandise is fueling incremental market share growth and increased R&D investment—alongside continued demand for accessible options like cheap carts in the broader consumer market.

Summary: Product Type Data & Market Contributions

| Product Type | 2024 Market Value / Volume | Key Growth Forecast | CAGR / Trend Notes |

|---|---|---|---|

| Hemp Fiber | ~$12.01B (2024) | ~$95.46B by 2032 | ~32.6% CAGR |

| Hemp Seed & Oil | ~$457M – $6.03B range (2024) | ~$858M – $10.89B by 2029 | 6.5% – 8.8% CAGR |

| Hemp Hurds / Shivs | ~43,000 tons used (2023) | Growing adoption in eco-construction and animal bedding | Strong volume growth |

| Specialty Extracts | Emerging & expanding | Higher adoption in cosmetics and personal care products | Upside potential |

Hemp fiber dominates the commercial hemp product mix and is predicted to account for a large portion of market sales due to broader industrial use and sustainable demand. Hemp seed and seed oil are rapid-growing segments, in particular in food, wellbeing, and personal care categories, with a call driven by means of dietary and plant-based product developments.

Hemp hurds/shivs support niche but growing markets, particularly in construction and animal care, including product diversification. Specialty extracts remain an evolving opportunity, especially for high-value applications beyond preferred fiber and seed markets, with increased interest tied to related sectors such as disposable carts.

Sources: (Verified Market Research), (globalgrowthinsights.com), (marketgrowthreports.com)

Regional Market Insights & Growth Patterns

North America

North America stays a dominant market because of advanced agricultural infrastructure, sturdy cultivation, and excessive commercial demand. Regulatory frameworks, which include the U.S. Farm Bill and agricultural subsidies, guide expansive manufacturing and commercialization.

Europe

Europe held around 31.04% of the worldwide commercial hemp market percentage in 2024, led by means of major manufacturers including France, which accounts for over 70% of local production, and the Netherlands.

Asia-Pacific

The Asia-Pacific area is projected to develop swiftly, with China and India rising as the main producers. Growing consumer awareness about sustainability and increasing business use cases, in addition, bolster regional momentum.

Other Regions

Latin America, the Middle East, and Africa are rising markets with evolving regulatory landscapes and growing interest in sustainable agricultural products, developing long-term opportunities for market growth.

Sources: Fortune Business Insights

Emerging Hemp Oil Market: Size & Forecast (2025–2032)

While industrial hemp presents flexible raw materials, hemp seed oil constitutes a distinct, excessive-growth phase, valued for its nutritional properties and wide consumer appeal.

Hemp Seed Oil Market Forecast

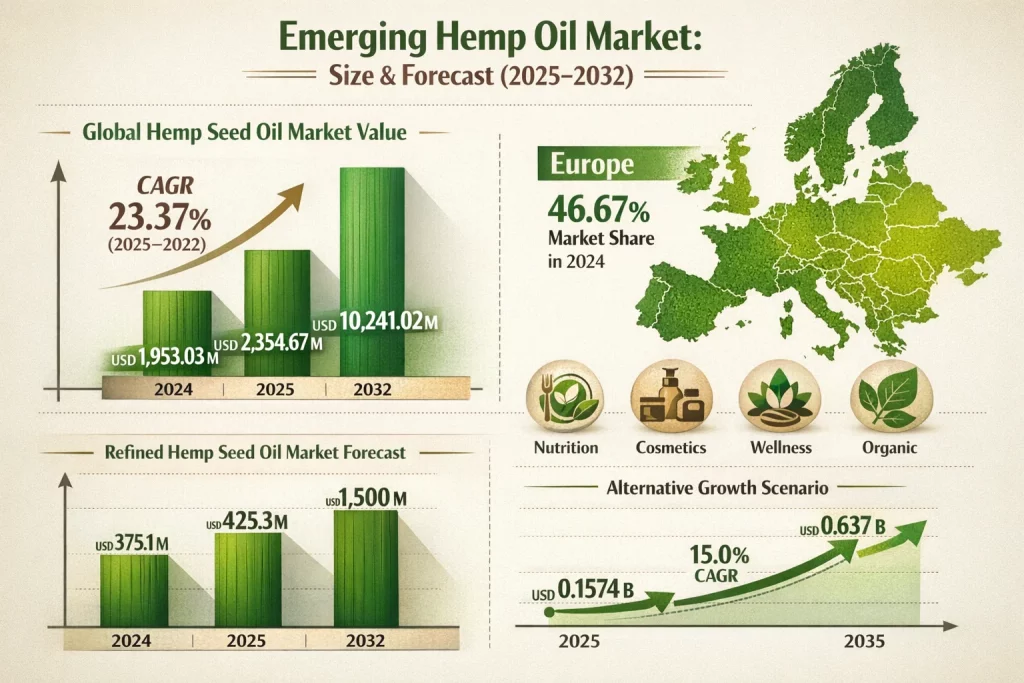

The global hemp seed oil market was valued at approximately USD 1,953.03 million in 2024, reflecting rising demand in nutrition, cosmetics, and wellness applications.

Market projections estimate the industry will grow to USD 2,354.67 million in 2025 and soar to USD 10,241.02 million by 2032 at a CAGR of 23.37% from 2025 to 2032.

Europe dominated this market in 2024 with a 46.67% market share, reflecting robust regulatory support, cultivation volumes, and consumer demand for organic, plant-based products.

Additional Hemp Oil Data Trends

Separate forecasts indicate the refined hemp seed oil market was valued at around USD 375.1 million in 2024, expected to reach USD 425.3 million by 2025, and approximately USD 1,500 million by 2035.

Other projections highlight alternative growth paths, with estimates suggesting hemp seed oil may expand from around USD 0.1574 billion in 2025 to USD 0.637 billion by 2035 at about a 15.0% CAGR.

Throughout these scenarios, the hemp oil segment constantly demonstrates double-digit annual growth, driven by rising consumer preference for herbal, organic, and plant-based ingredients.

Source: (Fortune Business Insights), (WiseGuy Reports), (Market Research Future)

Industrial Hemp Market Growth Drivers & Statistical Insights

Sustainability & Environmental Impact

Commercial hemp’s low water utilization and carbon sequestration ability, which includes up to 15 metric tons of CO₂ absorption consistent with a hectare yearly, make it attractive for weather-smart agricultural projects and circular economic system strategies.

Regulatory Tailwinds Driving Adoption

Guidelines allowing legal cultivation and processing have improved hemp acreage globally. For instance, the U.S. Department of Agriculture’s 2018 Farm bill catalyzed vast production, allowing over 21,400 registered growers by 2021 and laying the foundation for increased hemp-based commercial products.

Challenges & Market Restraints

R. Regardless of promising growth, the industrial hemp market faces key challenges:

Regulatory Complexity: various policies across regions complicate global trade and standardization.

Supply Chain Fragmentation: uneven cultivation and processing infrastructure introduces inefficiencies.

Competition from established materials: Hemp nevertheless competes with conventional plastics, artificial fibers, and traditional crop products, from time to time at pricing risks.

These restraints are large; however, are predicted to ease as global policy alignment improves and industrial integration scales.

Strategic Outlook & Future Growth Opportunities

Estimated growth across both industrial hemp and hemp oil markets opens up numerous opportunities for consumers and manufacturers:

Bioplastics & Bio-Composites: Expansion into sustainable alternatives to petroleum-based materials.

Functional Foods & Beverages: Increasing inclusion of hemp seed oil and derivatives in nutrition segments.

High-Performance Textiles: Adoption in eco-fashion and performance wear manufacturing.

Construction & Insulation: Hemp-based materials offering thermal benefits and reduced carbon footprint.

The combination of legislative support, technological advancements, and increasing consumer awareness collectively positions these markets for sustained expansion in the future.

Source: (Market Data Forecast Claight)

Final Inference

Given that, we can see the global industrial hemp and hemp oil markets are surely entering a sturdy growth segment. With market sizes projected to increase sharply through 2035, supported by sustainability goals, increasing applications, and improving regulatory clarity, hemp is turning into a mainstream commercial and consumer material.

From textiles and construction to nutrients and personal care, demand continues to increase, positioning both industrial hemp and hemp oil as long-term growth markets with stable fundamentals.