CBD Industry Market Size Growth

The global CBD industry is transitioning into mainstream wellness, pharmaceutical, personal care, and lifestyle categories with significant scale behind it. Market research data indicates that the CBD market is growing at one of the fastest compound annual growth rates within the broader health and cannabis industries. Continued advances in extraction technology, increased availability of hemp-derived CBD, and the expansion of digital and retail distribution channels are accelerating market penetration worldwide.

Content

– Key CBD Industry Market 2026 Insights

– Global CBD Industry Market Size

– Which CBD Products Are Driving Growth?

– Regional Breakdown Of CBD Market Share

– What’s Fueling This Growth? Statistically Backed Drivers

– What Sectors Are Using CBD Most?

Key CBD Industry Market 2026 Insights

– A 2025 forecast pegs the global cannabidiol market at around $9.46 billion in 2025.

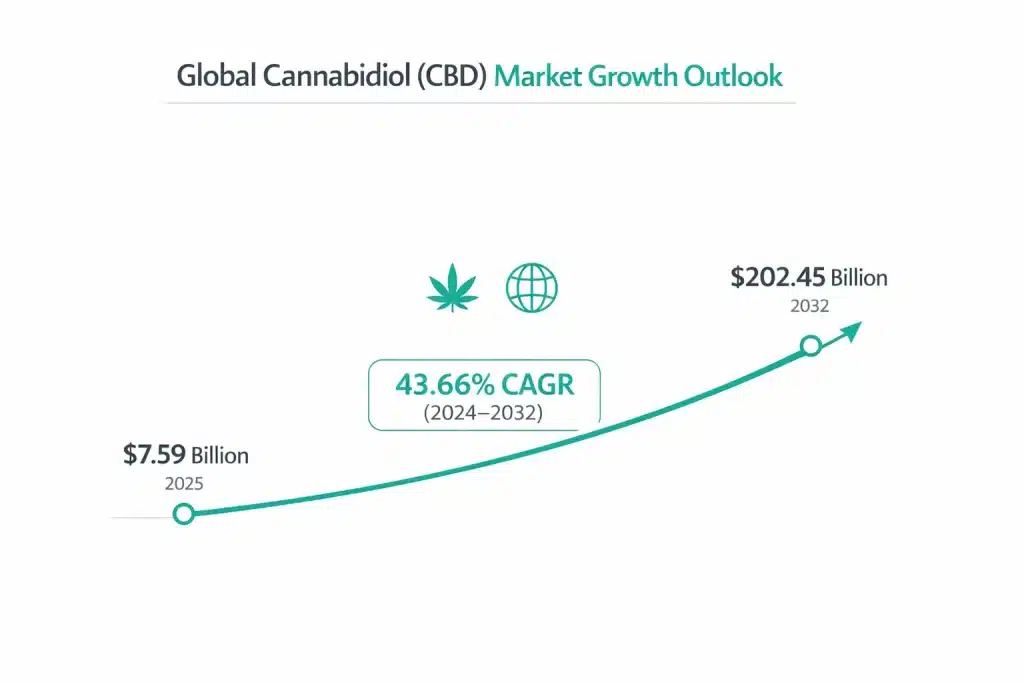

– It is expected to reach $202.45 billion by 2032. That’s a CAGR of ~43.7% from 2024–2032.

– Globally, the CBD vapes market was valued at about $2.26 billion in 2025 and is projected to reach roughly $2.85 billion by 2026.

– The CBD oil market size & growth, as per Data Bridge, is expected to reach roughly $82.17 billion by 2032.

– North America dominated ~47% of the global CBD market in 2025.

– A 2025 consumer study highlights that 65 percent of users recognize CBD for pain management and wellness benefits

Global CBD Industry Market Size

According to recent market research, the worldwide cannabidiol market continues to expand sharply. While a widely cited baseline figure shows the global market at $7.59 billion in 2025 and projected to reach $202.45 billion by 2032 with a 43.66% CAGR between 2024 and 2032, newer forecasts offer updated context for the next few years.

In practical terms, more recent intelligence suggests the CBD industry’s total valuation is likely to be in the low-to-mid-teens of billions of dollars by the end of 2025, with estimates ranging upward from about $10.68 billion in 2025.

A 2025 forecast from a leading consultancy pegs the global cannabidiol market at around $9.46 billion in 2025, with continued growth expected through the end of the decade.

Expected Near-Term Growth 2025–2026

Current projections show the market continuing to climb in 2025 and into 2026:

One major industry analysis projects the worldwide cannabidiol market at about $10.68 billion in 2025 and suggests it will continue upward in 2026.

The same forecast notes continued growth through 2033, with the global market more than doubling from its 2025 base over that period.

Though exact figures for 2026 vary by source, this positioning illustrates a durable multi-billion-dollar runway that’s already well underway.

Source: Fortune Business Insights, Grand View Research, Coherent Market Insights, Global Growth Insights

Which CBD Products Are Driving Growth?

CBD product categories demonstrate that CBD growth is no longer dependent on a single product type. Instead, it is being driven by a broadening portfolio that supports mainstream adoption across multiple industries.

CBD Vapes

CBD vapes are not just catching on; they are becoming a measurable force in the overall CBD market, drawing consumers who want fast effects, convenience, and a modern wellness experience.

Latest market forecasts show real momentum. Globally, the CBD vapes market was valued at about $1.68 billion in 2025 and is projected to reach roughly $2.26 billion in 2025, with continued strong growth expected through 2034 at a healthy pace. Disposable formats lead the way, holding more than half of the global vape segment thanks to ease of use and low barriers for new CBD users.

Looking slightly farther ahead, some projections peg the broader CBD vapes category at about $2.85 billion by 2026, with compound annual growth rates that suggest mainstream interest won’t slow soon.

Early data also speaks to consumer behavior shifts. More than 40 percent of adults under 35 in key markets prefer CBD vaping over other formats for perceived rapid effects, and 37 percent of existing nicotine vapor product users report trying or switching to CBD vapes.

These figures point to two clear trends: vaping is drawing new CBD consumers, and it’s broadening where CBD fits in everyday wellness routines.

CBD Oil

Zooming in on CBD oil, still the backbone of the industry’s product mix, separate research supports the growth story from a more product-specific angle:

One market report values the global cannabidiol oil (CBD oil) market at about $907.4 million in 2025 and projects it will continue expanding through 2033, reaching more than $6.6 billion by then.

This segment’s growth trajectory demonstrates that even within the broader CBD space, the oil category is building scale as consumer adoption widens:

Increasing use in wellness routines, therapeutic applications, and personal care products is driving this segment’s expansion.

Because CBD oil often serves as the entry point for consumer trust in the category (tinctures, capsules, topical formulations), its expanding market reinforces the total industry growth picture.

Now let’s isolate the CBD oil segment (because oil is still the backbone of the category):

CBD oil market size & growth as per Data Bridge:

– $17.30 billion in 2025.

– Expected to reach roughly $82.17 billion by 2032.

– That’s a 21.5% CAGR over the forecast period.

CBD oil remains the core product category and the primary entry point for consumers and medical users alike. Its versatility across wellness, therapeutic, and pharmaceutical applications continues to anchor overall market expansion.

Full-spectrum extracts, the type that includes a range of cannabinoids and terpenes, are expected to hold the largest share of the CBD oil market, as per Data Bridge Market Research.

The same research reports that CBD Isolates (pure CBD without THC or other compounds) are growing fastest in medical and precise dosing applications.

While CBD oil leads the market, other product categories are contributing meaningfully to growth and diversification.

Edibles And Beverages:

CBD edibles and beverages are gaining traction as consumers seek convenient, lifestyle-friendly formats. These products are increasingly positioned as functional wellness alternatives, and long-term projections suggest they will represent a multi-billion-dollar segment by the mid-2030s. Independent industry estimations suggest edible CBD products could reach $30-$38 billion by 2034, according to a post on Reddit.

Topicals & Personal Care:

Topicals and personal care products are also expanding rapidly, driven by rising interest in CBD-infused skincare, pain relief creams, and wellness balms. In certain consumer demographics, particularly beauty and self-care users, these products are growing faster than traditional oil formats.

In 2025, Global Growth Insights estimates put the global CBD skin care market worth between roughly $0.4 billion and over $5 billion, depending on how you slice the data and definitions. Even the most conservative figures show strong momentum heading into 2026 and beyond.

Beyond skincare alone, the broader CBD topicals market, which includes lotions, balms, transdermal patches, and pain relief products, was valued at about $3.5 billion in 2025 and is projected to keep growing at a healthy pace toward 2033, according to Market Research Intellect.

In plain language: if CBD oil is the “wellness tonic,” topical products are becoming the “daily self-care staple.” And in a market where personal care spending topped over $1 trillion globally in 2025 and continued rising through 2025, CBD-infused products are positioned to capture a bigger piece of that pie as consumers look for natural and functional additions to their routines.

Source: Global Growth Insights, Data Bridge Market Research Reddit, Global Growth Insights Market Research Intellect, Global Wellness Institute, Global Growth Insights, Business Research Insights

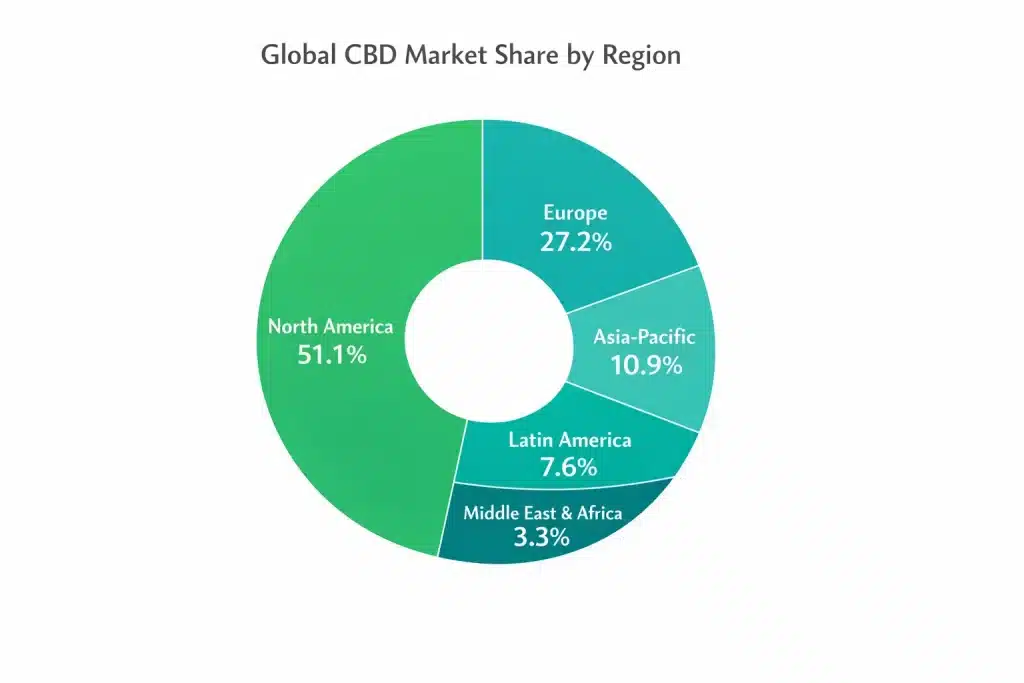

Regional Breakdown Of CBD Market Share

Regional shares for North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa are based on the most recent global CBD market analysis from Reports & Data, showing relative distribution across major regions.

North America

– North America dominated ~47% of the global CBD market in 2025.

– The U.S. market alone is expected to hit ~$78.74 billion by 2032.

– Data Bridge shows North America leads the CBD oil subset with about 42.5% of global revenue share in 2025.

North America isn’t just big, it’s the trendsetter. Whatever catches on here tends to ripple out globally.

Asia-Pacific

– Identified as one of the fastest-growing regions for CBD oil demand due to rising disposable incomes and evolving regulations.

Europe

– Growing steadily thanks to increased wellness adoption and clearer legal frameworks, especially for hemp-derived CBD.

Europe’s market size might trail North America, but its growth trajectory keeps climbing.

These figures help distribute the 53% “Rest of the World” into more detailed geography shares:

Estimated CBD Market Share by Region

| Region | Approx. % Share of Total Global CBD Market |

|---|---|

| North America | ~47% |

| Europe | ~25% |

| Asia-Pacific | ~10% |

| Latin America | ~7% |

| Middle East & Africa | ~3% |

How This Breaks Down Visually

If North America is 47% of the global CBD market, the rest of the world (53%) can be split approximately as:

– Europe: ~25%

– Asia-Pacific: ~10%

– Latin America: ~7%

– Middle East & Africa: ~3%

(These regional figures together sum close to the 53% remainder.)

Notes on the Data

– Europe: Around 25% share of the global CBD market according to regional analysis.

– Asia-Pacific: Roughly 10% share, with rapid growth potential even though the current base is smaller.

– Latin America: About 7%, led by early legal pathways in Brazil and Mexico.

– Middle East & Africa: Around 3%, due to gradual regulatory acceptance in markets like South Africa and the UAE.

Source: Fortune Business Insights, Data Bridge Market Research Reports, and Data

What’s Fueling This Growth? Statistically Backed Drivers

The CBD market’s growth is not random. It’s built on clear trends in consumer behavior, legal shifts, and product innovation that show up in the numbers.

Consumer Awareness and Demand Are Rising Fast

The CBD market is moving well beyond niche circles. In 2025, the global cannabidiol market was estimated at around $10–14.6 billion, reflecting robust mainstream interest in wellness and therapeutic CBD products. Consumer recognition of CBD’s potential benefits, from anxiety and pain support to sleep and inflammation relief, is lifting demand across age groups and use cases.

A 2025 consumer study highlights that 65 percent of users recognize CBD for pain management and wellness benefits, shaping choices from oils to vapes and topicals.

That awareness is showing up in purchasing behavior and product diversity as people look for natural alternatives to synthetic options.

Regulatory Shifts Are Opening Markets

Regulatory clarity continues to unlock retail channels and consumer access. While the 2018 U.S. Farm Bill laid the foundation federally, 2025–2026 sees more countries and regions easing restrictions on hemp-derived CBD. Nearly 30–50 countries have frameworks permitting legal hemp or CBD products, which directly expands where CBD can be sold and marketed.

Legal access doesn’t just open doors. It builds trust. Retailers are allocating more shelf space, and mainstream stores now stock CBD alongside traditional wellness brands.

Product Innovation Is Driving Broader Adoption

The CBD industry is innovating fast. Here’s how that shows up in the data and trends:

Formulation advances: Products using nano-emulsions and novel delivery systems (better absorption and dosing control) are drawing customers who want consistency and performance.

Format expansion: Beyond oils and capsules, topicals, edibles, beverages, pet wellness formulas, and especially vape products are fueling category momentum. Diversification makes CBD relevant in routine wellness, recovery, and lifestyle contexts, not just medicinal niches.

E-commerce acceleration: Digital sales channels remain critical, with online platforms capturing significant market share thanks to convenience and education-focused shopping experiences.

These innovations help bring in new consumers and keep existing users engaged.

Source: Business Wire, Persistence Market Research, Accio Emergen Research, Data Bridge Market Research, Persistence Market Research, Global Growth Insights

What Sectors Are Using CBD Most?

Understanding where CBD is actually being used tells you where the real demand is happening. The numbers show that adoption isn’t limited to one corner of the market. It’s spreading across health, beauty, food, and beyond.

Pharmaceutical & Medical

The pharmaceutical and medical sector remains one of the biggest users of CBD products, especially where therapeutic claims like chronic pain support, anxiety management, and clinical applications matter. In 2025, pharmaceutical applications accounted for an estimated around 41–48 percent of the total CBD market share, driven by medical-grade formulations and increasing acceptance among healthcare professionals.

Wellness & Personal Care

The wellness and personal care segment is a major growth engine in 2025–2026. Wellness-oriented use cases now rival traditional medical ones. In fact, some reports show that wellness-driven CBD products, including skincare and functional health drops, are accounting for significant single-digit to double-digit percentage growth rates within the broader market, reflecting everyday health and beauty demand.

Food & Beverages

According to multiple 2025 forecasts, the CBD food and beverage application accounts for roughly 15–35 percent of overall use in some markets, with functional beverages and edibles mirroring the broader CBD trend. Demand in this space is tied to convenience, familiar formats, and a growing consumer preference for wellness alternatives that fit into daily routines.

Source: Fortune Business Insights, Mordor Intelligence, Persistence Market Research, Global Growth Insights

Conclusion

When we consider all points, we have to acknowledge that the actual market size of the CBD industry is rapidly moving in a growth direction. What started as a fringe wellness product has clearly moved past the trial phase and into full-scale adoption across pharma, personal care, food, beverages, and lifestyle categories.

Looking at the numbers, it shows consistent demand across regions, product formats, and consumer groups. Oils continue to anchor trust, vapes are pulling in younger and experience-driven users, edibles and beverages are normalizing CBD in daily routines, and topicals are quietly becoming self-care staples. When demand spreads this wide, it usually sticks.