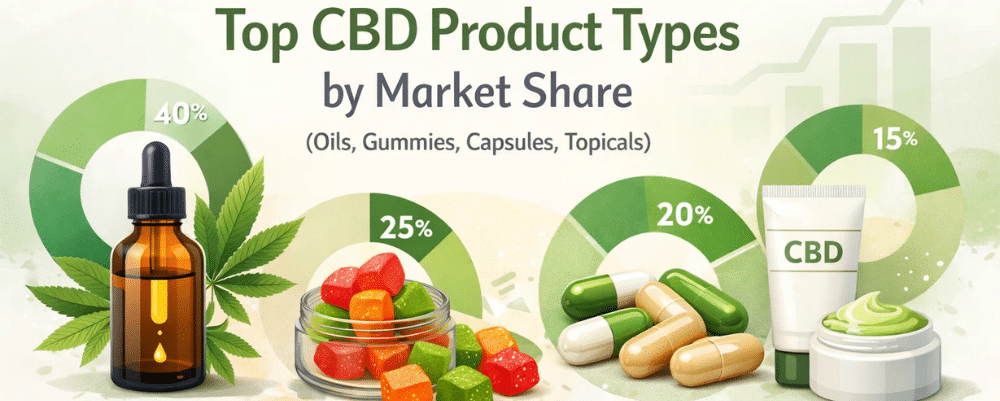

Top CBD Product Types by Market Share (Oils, Gummies, Capsules, Topicals)

CBD by the Numbers: Top Product Types and Market Share in 2025

The CBD industry has moved far beyond being a niche health trend. In 2025, it is a full-blown global powerhouse, with products sitting on the shelves of mainstream supermarkets and local pharmacies alike. But as the market grows, the way people use CBD is shifting. We’ve moved past the days when “CBD” just meant a bottle of bitter oil. Today, the market is defined by choice, convenience, and specific health goals—ranging from gummies and topicals to emerging options like delta 8 flower for users seeking alternative experiences.

This report breaks down the current market share of the top CBD product types, Oils, Gummies, Capsules, and Topicals, analyzing why some are staying on top and which ones are catching up fast.

Statistical Highlights: The CBD Product Landscape at a Glance

If you are looking for a quick look at where the money is moving in 2025, here are the standout figures defining the market today.

| Metric | 2025 Data Point | Market Significance |

|---|---|---|

| Global Market Size | $10.68 billion | A massive leap from just $7.59B in 2023 |

| Market Leader | CBD Oils & Tinctures | Holds a dominant 36.0% revenue share |

| Fastest Climber | CBD Gummies | Projected 29.2% CAGR through 2032 |

| Primary Use Case | Pain Relief | Cited by 64% of all active CBD users |

| Regional Giant | North America | Accounts for 85.8% of global revenue share |

1. CBD Oils and Tinctures: The Industry Anchor

Oils remain the “face” of CBD. They were the first products to hit the mainstream, and they continue to dominate the revenue charts. In 2025, they are still the preferred choice for those who want a “medical-grade” feel to their wellness routine.

Market Share: As of late 2025, CBD oils and tinctures capture approximately 36% to 43% of the total global market revenue.

Why They Stay on Top: The main reason for their dominance is versatility. You can take them sublingually (under the tongue) for fast absorption, a method preferred by 65% of regular users, or mix them into morning coffee or smoothies.

Medical Acceptance: Oils are the primary format used in pharmaceutical research. Because they allow for “microdosing” (measuring out exact drops), they are favored by people treating chronic conditions like epilepsy or severe anxiety.

2. CBD Gummies and Edibles: The Modern Favorite

While oils have a history, gummies have the momentum. The transition of CBD from a “supplement” to a “lifestyle product” is most visible here. Gummies are no longer just for fun; they are becoming a daily staple for Gen Z and Millennials.

Explosive Growth: The CBD gummies market was valued at $4.46 billion in 2024 and is expected to hit nearly $35 billion by 2032.

Segment Leader: Within the edibles category, gummies account for 72% of total sales.

The “Convenience” Factor: People choose gummies because they taste better and are easier to take on the go. Unlike oils, there is no measuring out drops or worrying about leaks in your bag. This convenience has made them the second most common way to consume CBD globally.

Table: Projected Revenue of CBD Product Segments (USD Billions)

| Product Type | 2024 Value | 2032 Projected Value | Growth Outlook |

|---|---|---|---|

| Oils / Tinctures | $4.2B | $11.1B | Steady / Maturing |

| Gummies / Edibles | $4.4B | $34.6B | High Growth |

| Topicals / Creams | $2.1B | $5.8B | Niche / Targeted |

| Capsules / Pills | $1.8B | $4.2B | Stable |

3. CBD Capsules and Softgels: The Reliable Routine

Capsules are the go-to for the “set it and forget it” crowd. They appeal heavily to older demographics and those who treat CBD like a daily vitamin rather than a recreational treat.

Steady Presence: About 18% of CBD users prioritize capsules and tablets over any other method.

Precision Dosing: The big draw here is the exactness. Each capsule has a pre-measured dose (usually 10mg or 25mg), which removes the guesswork that comes with oils.

Wellness Integration: We are seeing a rise in “benefit-specific” capsules. These products blend CBD with other ingredients like Melatonin for sleep or Turmeric for inflammation, helping this segment stay relevant in a very crowded market.

4. CBD Topicals: The Niche for Physical Relief

Topicals—think creams, lotions, and roll-ons—don’t enter the bloodstream like the others. Instead, they interact with receptors directly in the skin and muscle tissue, making them a completely different option from inhalables like cheap carts.

Targeted Relief: Around 62% of all CBD users use products for pain relief, and 22% to 26% of users specifically prefer topical balms for direct application to sore joints.

The Beauty Boom: CBD is increasingly showing up in high-end skincare. The “Personal Care & Cosmetics” segment is expected to be one of the fastest-growing end-user categories as mainstream beauty brands jump on the CBD bandwagon to market their anti-inflammatory properties.

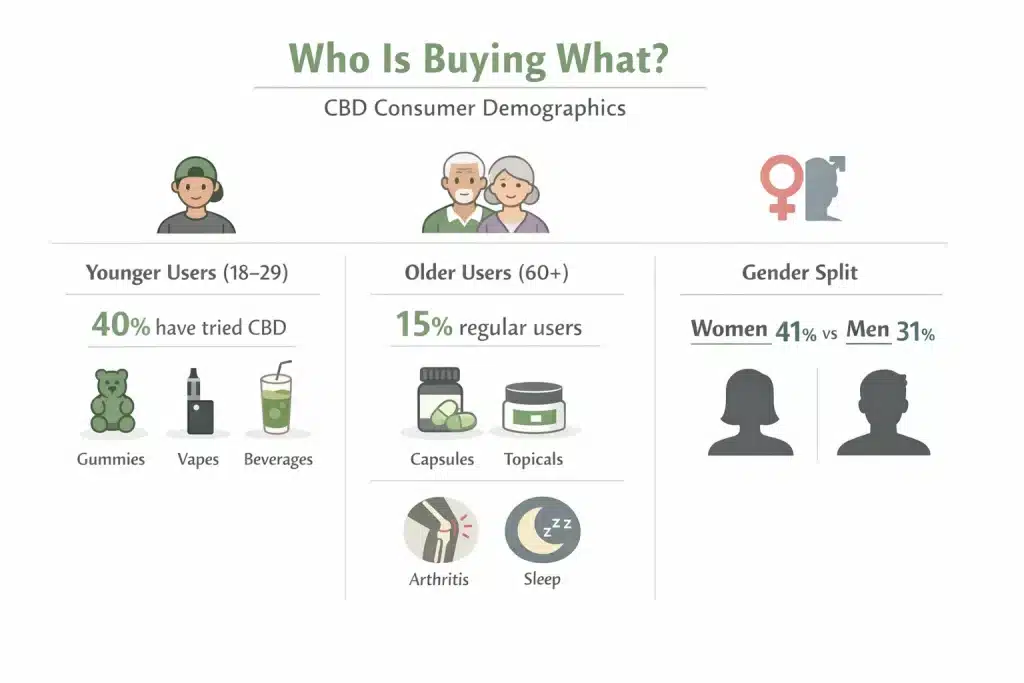

5. Who is Buying What? (Consumer Demographics)

The data shows that who you are often dictates how you take your CBD.

Younger Users (18-29): This group is the most likely to try CBD, with 40% having used it at least once. They overwhelmingly favor gummies, vapes, and beverages.

The “Golden” Demographic (60+): While only 15% of this group uses CBD regularly, they are a massive growth driver for the capsule and topical segments, primarily using it for arthritis and sleep.

The Gender Split: Women are more likely than men to use CBD, with 41% of women reporting use compared to 31% of men. Women tend to use it for anxiety and sleep, while men lean toward pain relief.

6. The 2025 Market Drivers: Why the Surge?

Why is the market hitting these multi-billion dollar numbers now?

Legalization & Trust: The U.S. Farm Bill and similar global reforms have moved CBD from “gray market” to “mass retail.”

Pet Industry Opportunity: Almost one-quarter (25%) of U.S. pet owners now use CBD for themselves or their pets. CBD for dogs is no longer a niche; it is a mainstream wellness category.

B2B Dominance: Interestingly, the B2B segment (businesses selling to other businesses) accounted for over 55% of the market share in 2025, as food, beverage, and cosmetic manufacturers buy CBD in bulk to infuse into their own products

Conclusion: A Market Moving Toward Specific Solutions

The numbers for 2025 tell a very clear story: convenience and specificity are winning. While CBD oils still hold the largest share due to their clinical history and precise dosing, the gap is closing fast as consumers increasingly turn to options like Delta 8 edibles for ease of use and targeted effects.

Gummies are the clear winner for new users and those looking for a lifestyle-friendly option, while topicals have earned a permanent place in gym bags and medicine cabinets for those seeking physical relief. As we look toward 2030, the market is expected to shift away from “general CBD” and toward “Targeted CBD”—products formulated for specific needs like sleep, focus, or recovery, a trend already reflected in curated offerings from MyDelta8Store.