Global Vaporizer Market Size 2025–2026

The global vaporizer market is reaching new heights, as the vaporizer industry stands out as one of the fastest-growing segments in consumer devices, driven by smoking alternatives and inhalation technologies. The reasons behind this acceleration of the market are that users seek cleaner, more convenient, and more adaptable ways to consume nicotine, cannabis, and therapeutic compounds.

Below are the latest statistics of the global vaporizer market with concrete data for 2025 and projections shaping expectations for 2026 and beyond.

Content

– Key 2026 Statistics of the Global Vaporizer Market Size

– What Is The Global Vaporizer Market Size In 2026?

– Total Industry Global Vaporizer Market

– Vaporizer Market Key Segments

– Projected CAGR For Vaporizer Market Segments

– E-Cigarette + Vaporizer Combined Market

– Vaporizer vs Other Categories Growth Drivers

– Regional Analysis of the Global Vape Market

Key 2026 Statistics of the Global Vaporizer Market Size

– The global vaporizer market was valued at approximately $27.57 billion in 2024.

– Estimates for 2025 put the market between $27.08 billion and $41.9 billion, depending on which segments are included.

– By 2026, the market is projected to reach between $31.3 billion and over $42.8 billion.

– The total vaporizer market is expected to grow at a compound annual growth rate of about 24.7% from 2024 to 2029.

– The e-cigarette and vape segment was valued at roughly $35.7 billion in 2024.

– This segment is projected to reach $65.2 billion by 2029.

– Cannabis vaporizers accounted for around $5.8 to $6.0 billion in 2024 and 2025.

– The cannabis vaporizer market is expected to grow to between $9.85 and $13.06 billion by 2030.

– Medical and other vaporizer applications were valued at approximately $1.16 billion in 2021 and are projected to reach $1.98 billion by 2031.

– The combined e-cigarette and vaporizer market is expected to grow from $27.078 billion in 2025 to $100.763 billion by 2034, representing a CAGR of about 15.7%.

What Is The Global Vaporizer Market Size In 2026?

As per the latest statistics of Market Research Future, “the global vaporizer market size was valued at approximately $27.57 billion in 2024. Furthermore, it is projected to reach $83.38 billion by 2029, growing at a compound annual growth rate (CAGR) of about 24.7% during the forecast period. Another report estimates the e-cigarette and vape segment alone was $30.20 billion in 2024 and could reach $182 billion by 2035.

Source: Market Research Future

Total Industry Global Vaporizer Market

The global vaporizer market size displays how much revenue the industry generates worldwide over time, and 2024 through 2026 is shaping up to be a period of solid growth.

| Year | Market Size (USD) | Growth Notes |

|---|---|---|

| 2024 | ~$27.1 billion | Baseline figure from recent industry data |

| 2025E | $27.078B – $41.9B | Estimates vary by source — differences reflect market scope |

| 2026F | $31.3B – $42.8B+ | Modest to strong growth implied by CAGR forecasts |

Looking at the projections of e-cigarette + vaporizer bundles or the wider vaporizer segment, analysts agree the market will expand significantly by 2026.

In 2024, the industry is estimated at around $27.1 billion.

Moving into 2025, estimates start to diverge, and that’s normal. Different analysts define the market in slightly different ways. One range puts total value at roughly $27.08 billion, closely tracking the previous year. Another projection goes as high as $41.9 billion, reflecting a broader view that includes e-cigarettes, consumer devices, and newer vaping technologies. The variation isn’t a contradiction; it’s a signal that the market is both complex and rapidly evolving across segments.

By 2026, forecasts continue to show upward momentum. Conservative projections estimate around $31.3 billion, indicating steady growth from the 2024 baseline. On the high end, forecasts push beyond $42.8 billion, suggesting strong adoption and product innovation are accelerating demand. These higher figures are influenced by continued consumer interest, regulatory shifts, and expanding usage in both nicotine and cannabis-related vaporizers.

Source: businessresearchinsights.com

Vaporizer Market Key Segments

| Segment | 2024/2025 Market Size | Projected 2029/2030 Market Size |

|---|---|---|

| Total Vaporizers | ~$27.5 – $34.5 billion | ~$83.4 billion (by 2029) |

| E-Cigarette & Vape | ~$35.7 billion | ~$65.2 billion (by 2029) |

| Cannabis Vaporizers | ~$5.8 – $6.0 billion | ~$9.85 – $13.06 billion (by 2030) |

| Medical / Other | ~$1.16 billion (2021) | ~$1.98 billion (by 2031) |

These projections suggest that the total vaporizer market could reach around $83.4 billion by 2029, driven by rising health awareness, rapid device innovation, and expanding cannabis legalization.

The e-cigarette and vape segment is already larger in raw revenue, sitting at roughly $35.7 billion. Growth here is steadier but still strong, with the market expected to reach $65.2 billion by 2029.

Cannabis vaporizers represent a smaller but highly dynamic slice of the market. Valued at around $5.8 to $6.0 billion, this segment is expected to grow to between $9.85 and $13.06 billion by 2030.

Finally, the medical and other vaporizer applications remain the most conservative segment. Valued at approximately $1.16 billion in 2021, it’s projected to reach about $1.98 billion by 2031.

Taken together, these segments show a market that’s expanding on multiple fronts, from consumer lifestyle products to regulated medical tools, each contributing to the industry’s long-term growth. Standalone vaporizers are evolving rapidly, and MD8S offers a variety of sleek, portable devices that fit right into this growing trend, including options for disposable THC vapes online cheap without compromising on quality or convenience.

Source: Grand View Research

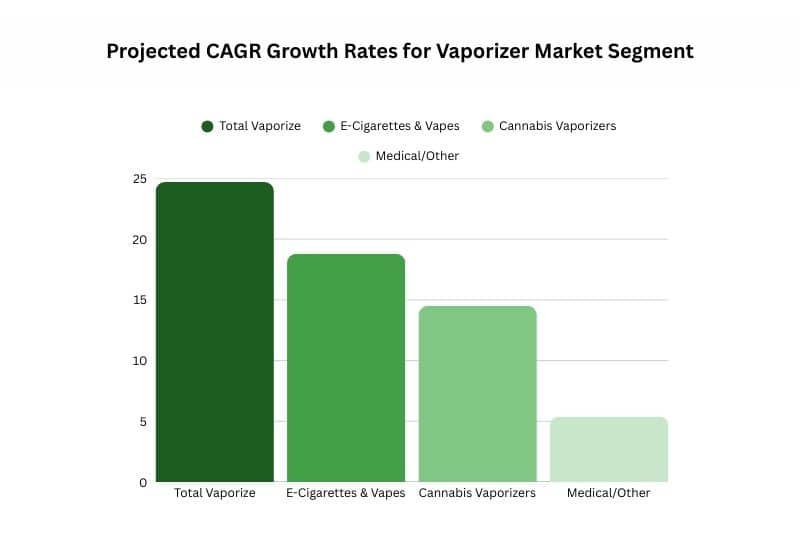

Projected CAGR For Vaporizer Market Segments

The total vaporizers market is projected CAGR of about 24.7%. It shows just how fast adoption is accelerating across consumer categories.

The e-cigarette and vape segment is projected 18.8% CAGR; this segment remains a major revenue engine for the industry.

Legalization across multiple regions, demand for discreet consumption, and the rise of online sales channels are pushing the growth of Cannabis vaporizers at a projected 14.4–14.5% CAGR.

The medical and other vaporizer applications remain the most conservative segment, growing at a slower 5.4% CAGR.

Source: Grand View Research

E-Cigarette + Vaporizer Combined Market

Another way to view the industry is through the lens of the e-cigarette + vaporizer market:

| Market Name | 2025 Value | 2034 Projection | CAGR |

|---|---|---|---|

| E-Cigarette + Vaporizer Market | ~$27.078B | ~$100.763B by 2034 | ~15.7% |

This combined figure highlights the strength of traditional e-cig products bundled with vaporizers in market estimates. Analysts also note strong adoption in North America and the Asia Pacific as key demand drivers.

Source: businessresearchinsights.com

Vaporizer vs Other Categories Growth Drivers

Here’s an illustrative breakdown you can use to show which sub-markets are growing fastest (based on comparable data):

| Segment | 2025 Size Estimate | Key Drivers |

|---|---|---|

| Broad Vape + E-Cig Market | ~$27B+ | Mass consumer adoption, regulatory shifts |

| Vaporizers (standalone) | ~$41.9B | Tech innovation, portable preference |

| E-Cigarette Segment (subset) | ~$19.6B | Popularity of nicotine alternatives |

| Cannabis Vaporizer Segment | ~$6.35B | Legalization and recreational use trends |

At a glance, the broad vape and e-cigarette market leads with $27B+ in 2025, and for good reason. Mass consumer adoption keeps expanding, while regulatory shifts continue to reshape how products are sold and marketed. In short, scale does the heavy lifting here.

Meanwhile, standalone vaporizers push even further, reaching an estimated $41.9B. Not just because they exist, but because they evolve. Rapid tech innovation, smarter temperature control, and an undeniable preference for portable devices give this segment a clear edge.

At the same time, the e-cigarette subset, valued at around $19.6B, thrives on a different driver altogether. Popularity as a nicotine alternative keeps demand steady, especially among users seeking familiar habits with modern delivery.

Then there’s the cannabis vaporizer segment, smaller at $6.35B, yet impossible to ignore. Legalization opens doors, recreational use fuels curiosity, and discreet consumption seals the deal.

Source: (businessresearchinsights.com), (Future Market), (Insights Industry Research), (fundamental businessinsights.com)

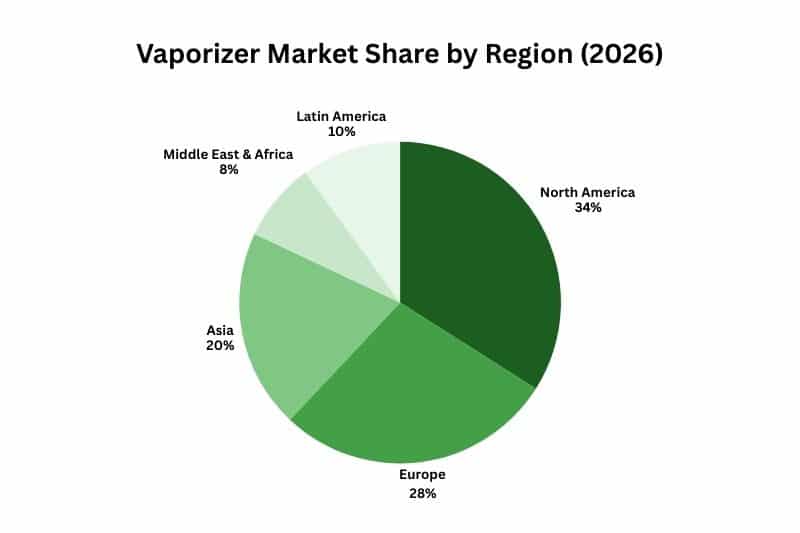

Regional Analysis of the Global Vape Market

Based on geography, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The North American region maintained more than 34 percent of the worldwide vaporizer market during 2025, according to Global Market Insights Inc. North America dominates in adoption, and MD8S caters directly to this market with fast shipping, verified products, and popular brands—making it easier for consumers to find a cheap cart without sacrificing quality. Canadian and American locations ruled the regional markets.

In 2025 The California Department of Tax and Fee Administration empowered 1,089 retail vape stores to operate within this market region. The established laws, together with high consumer literacy about vaporizers and major industry participation, create an advanced marketplace for vaporizer products. The United States Food and Drug Administration initiated seven cannabis vaporizer product recalls during 2022 in order to showcase its active regulatory presence within this region.

Strong expansion opportunities exist in Europe since the Federal Centre for Health Education in Germany determined that 19% of cannabis consumers use vaporizers. The UK Medicines and Healthcare products Regulatory Agency has approved 14 medical cannabis vaping products for use, while Germany’s Federal Institute for Drugs and Medical Devices works with 21 authorized importers for cannabis vaporizers. Market development continues steadily, but regulation progresses at different speeds across nations—shaping availability and demand, including interest in cheap disposable carts.

The Asia Pacific market holds potential growth opportunities for the future despite being new to the industry. The Thai FDA approved 88 vape devices for registration in 2023, but Japanese customs confiscated 142 cannabis vapes during the same period. The success of this region depends on changing laws and medical cannabis applications gaining public acceptance.

Source: Fortune Business Insights

Final Inverse

Looking at the numbers and trends, the global vaporizer market is clearly on a fast track. From a baseline of around $27 billion in 2024, estimates for 2025 already show a wide range from $27 billion to nearly $42 billion, depending on which segments are included. By 2026, most forecasts point toward continued upward momentum, with conservative estimates around $31 billion and optimistic projections pushing past $42 billion. This isn’t just growth for the sake of growth; it reflects real consumer demand for cleaner, more convenient ways to consume nicotine, cannabis, and therapeutic compounds.

The different segments tell an interesting story. E-cigarettes and traditional vapes still make up the largest revenue share, driven by mass adoption and steady demand for nicotine alternatives. Standalone vaporizers are gaining traction through innovation, smarter temperature control, portability, and diverse applications. Cannabis vaporizers, though smaller in revenue, are arguably the most dynamic segment, fueled by legalization trends and recreational use. Medical and specialized vaporizers remain modest but stable, showing that even niche applications have a seat at the growth table.

Geographically, North America leads the charge, combining high consumer literacy with a well-regulated market. Europe is steadily expanding, with regulations and approvals gradually supporting market growth. Asia Pacific is more of a wild card; it’s still emerging, but shifting laws and growing acceptance of medical cannabis could make it a key player in the next decade.

Overall, the market is reaching peaks on multiple fronts: technology, regulation, and consumer behavior all intersect to create an environment ripe for expansion. Now it’s clear for investors, manufacturers, and curious observers that the vaporizer market isn’t slowing down. With market growth accelerating, checking out mydelta8store latest products is a smart way to experience the innovation shaping the vaporizer industry firsthand. The next few years are going to be fascinating to watch, and the opportunities are as diverse as the products themselves.